In early May 2021, the American Bankers Association held their ABA Innovation Expo virtual conference.

Two of the sessions presented by Robert Morgan (SVP, Office of Innovation) stood out in highlighting how banks are implementing innovative technology as well as in revealing surprising insights into how fintechs and banks are evolving with digital lending.

The State of (Digital) Banking

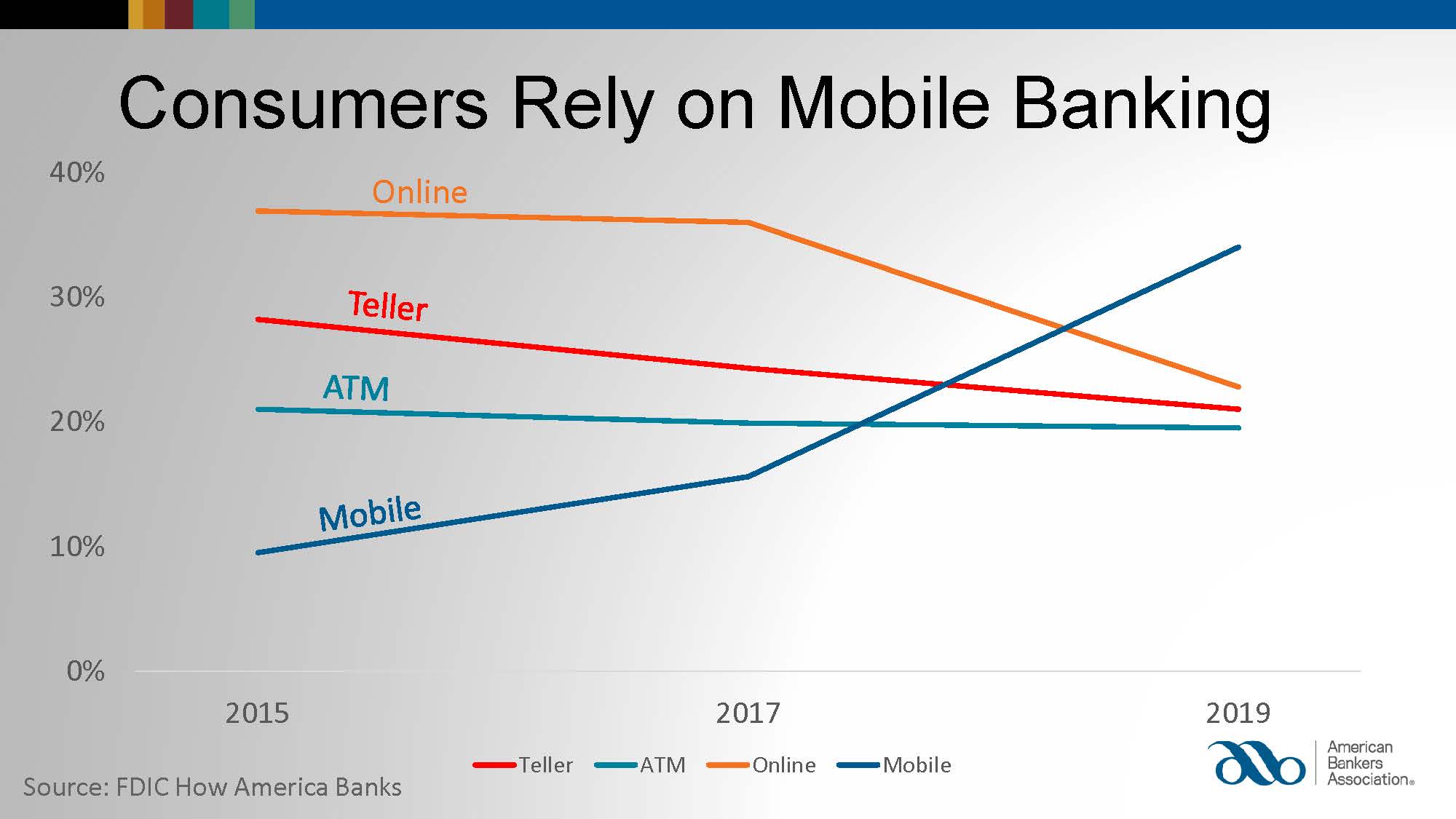

It should come as no surprise at all that banking has changed in the last several years, and digital banking (with or without traditional banks) has been a leading driver of these changes. Online and mobile banking, especially in the age of the COVID pandemic, have become critical components of the banking ecosystem.

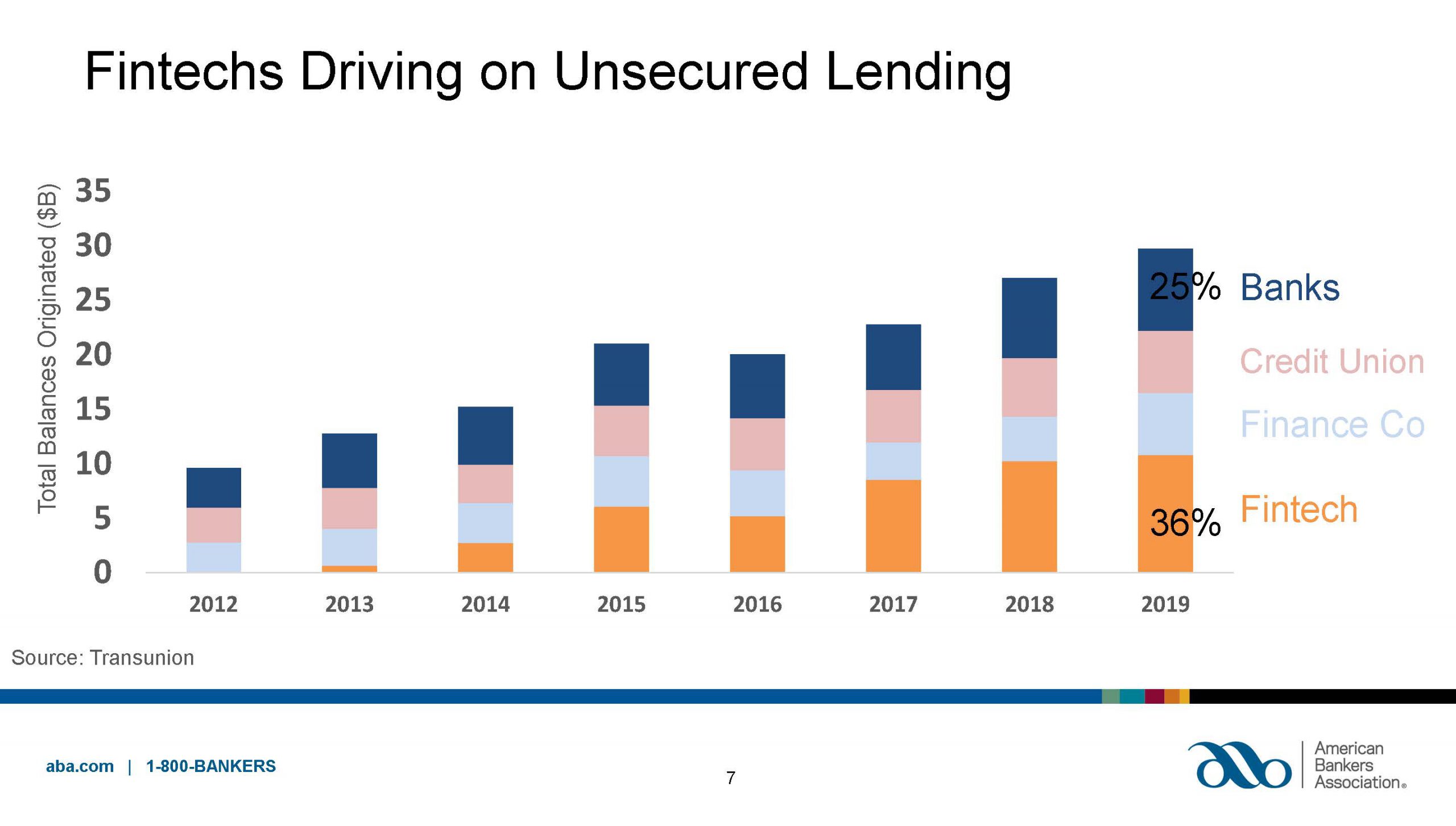

Fintechs emerged over the previous decade, too, as major competitors to banks, especially in the lending and, specifically, unsecured lending spaces.

The growth in unsecured lending by fintechs was explosive from 2012 through 2019, and for good reason: the process was much faster or even instantaneous and much more streamlined compared to applying for an unsecured loan from a customer’s primary bank.

We’ll come back to that issue in a moment.

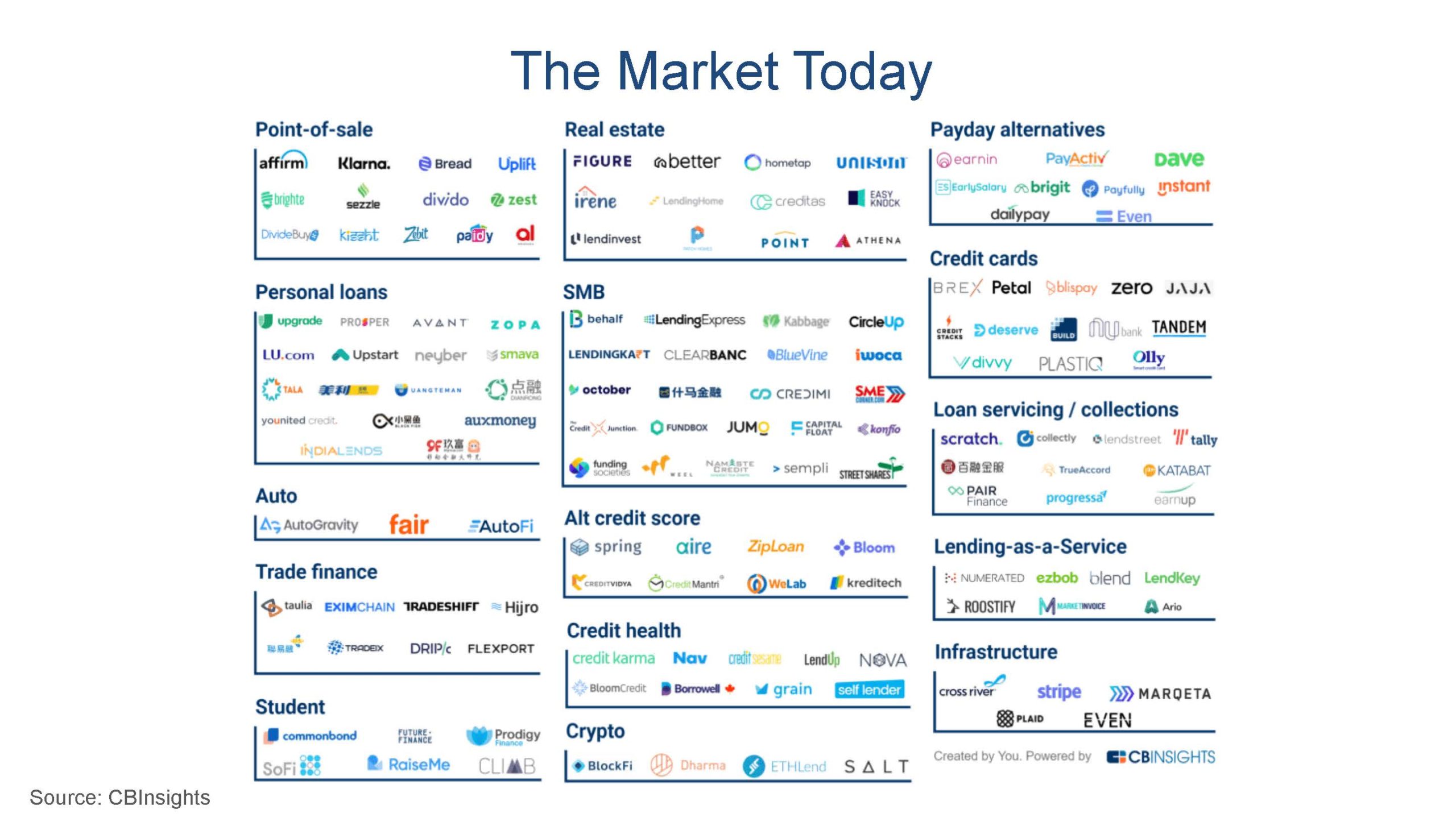

Unsecured lending isn’t the only area where fintechs and technology in general are disrupting traditional banking. From deposit products to credit cards to car loans and credit scores, there are a lot of new players to consider, and there are more by the day.

The bottom line on where banking (via traditional banks or non-bank fintechs) stands can be summed up by this quote from Morgan:

Banks are no longer competing with the branch down the street from a customer experience standpoint. Banks today are competing with their customer’s last best experience. So if your customer experience feels dramatically different from that of an Amazon or Google, customers are likely to question why and hold you to that sort of standard.

But while customer expectations have evolved, the business of banking and the role of trust, according to Morgan, have not, and that leads us into the next era of fintech and banking.

From Fintech 1.0 to Fintech 2.0 (and Why)

“The First Age of the Fintech” can be considered to be the emergence of non-bank competitors for customers seeking products and services that would all have traditionally been managed by the local branch. Importantly, fintechs have tended to be very focused on one or a few core “pieces” of the banking puzzle.

As the industry has evolved, however, fintechs seem to be moving in one of two big new directions:

- Becoming more like traditional banks in offering more products (or even seeking charters to become banks in truth)

- Partnering with banks to offer the benefits of adaptable, agile technology with the trust and financial base of traditional banks

The big driver for both, I expect, is that customer satisfaction with fintechs is very low compared to banks.

What does “fintechs partnering with banks” actually look like? Morgan listed three major categories or approaches to such endeavors:

- Infrastructure wherein the fintech provides technology that works on the back end of banking systems; these might be integrations with other services, data analysis tooling, advanced core banking software systems, and more

- White Labelled Products that offer modern, streamlined experiences hosted and managed by the fintech but branded to look and feel like the partner bank’s own experience

- Referral Services through which banks pass customers along entirely to fintech companies

This “Second Age of Fintechs” is an incredibly exciting time to be in the business of banking.

Focusing on the first two categories (infrastructure and white-labelled services), banks will be able to offer the streamlined, digital-first experience customers expect while retaining the benefits of trust and greater access to capital, and they’ll be able to keep the customer in the process.

The old adage that “80% of your business comes from 20% of your customers” is most certainly true of traditional banking, and now banks will be more able to avoid the constant churn of finding new business to replace what fintechs had been taking away.

In fact, this is the very approach we’ve been pursuing for years here at Premier Insights with our Radiant Lending web-based products: a combination of cloud-based infrastructure for lending polished with white-labelable features that mean our customers can streamline their lending process, offer modern features and accessibility to customers, and do it all without major CapEx and investment on in-house software and hardware to support it.

This is without doubt the direction the technology ecosystem in general has been trending for years, and we’re excited to see our banking industry following suit.

The ABA’s Innovation Expo featured a number of exciting talks including the two discussed in this post. If you weren’t able to attend, I can highly recommend spending some time watching the replays available (at the time of writing) on their expo page here.

Finally, make sure you’re subscribed to the Premier Insights blog for more on emerging topics in financial and regulatory technology!