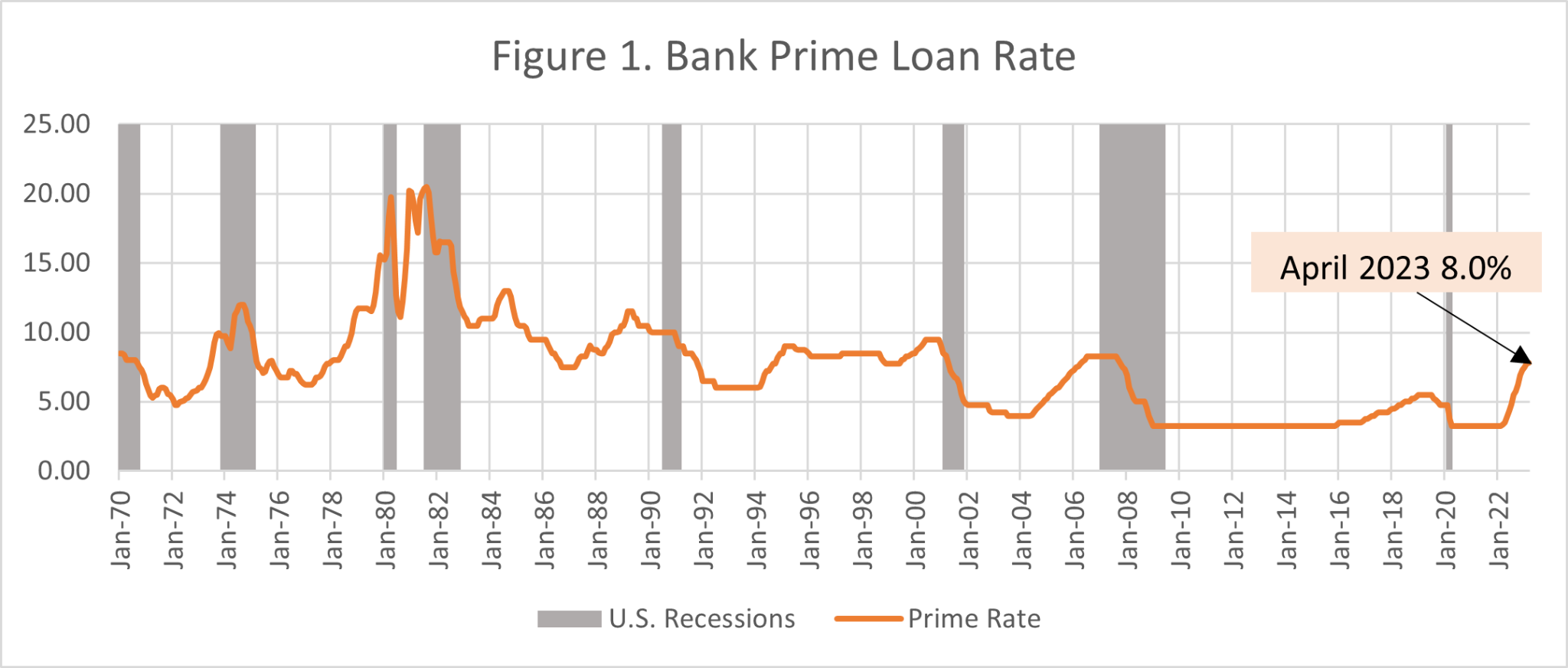

Credit conditions have changed rapidly and have created a situation for lenders which is very different than just a few years ago. As an illustration, consider the historical prime loan rate as shown in Figure 1.

After years of volatility, the prime rate fell to an historically low 3.25 percent in the middle of the 2008-2009 recession. The prime rate remained at that level until almost the end of 2015, when it began to rise gradually. This long period of stable and low rates was unprecedented. Banks were forced to adjust to very tight margins in order to remain profitable.

While the prime rate creeped upward between 2016 and 2019, it never reached what would be considered a high level. Rates then fell back to 3.25% in the midst of the COVID crisis. However, rates have risen sharply since the end of the first quarter of 2022. As of April 25, 2023 the prime rate was 8.0%, just shy of the 2008-2009 highwater mark of 8.25%.

Rates have risen 4.75 percentage points within a year’s time.

Like most things in economics, changes in environments tend to have both expected and unexpected consequences. While most recognize the impact of higher rates, including reduced loan demand, one effect that may be overlooked is the impact of higher rates on asset quality.

As rates increase, those who can most afford to avoid borrowing will do so, meaning the overall credit quality of loans diminishes. Conversely, individuals with average or poor credit often have no other option than to borrow despite the higher rates.

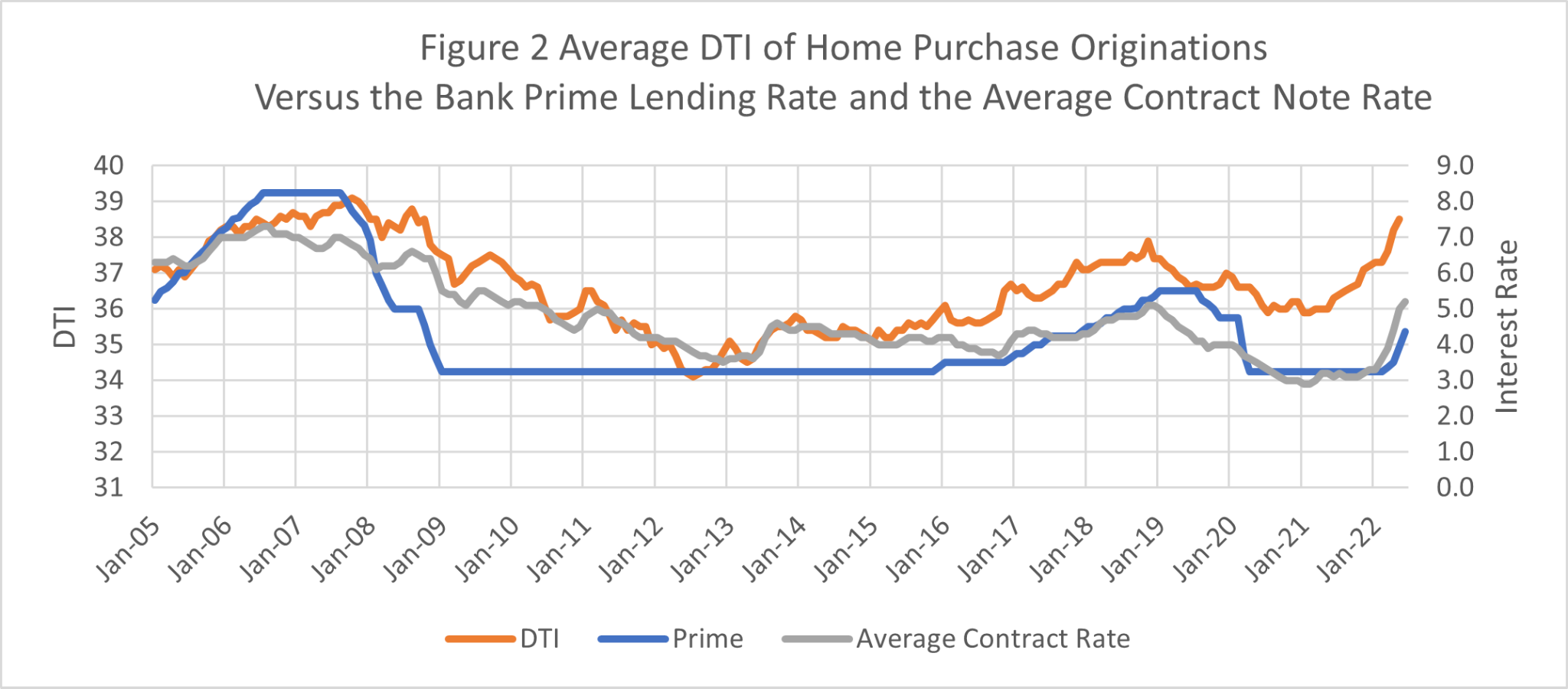

We can see this graphically in Figure 2 which shows historical average Debt-to-Income ratios for U.S. mortgage originations for home purchases.

Although the mortgage origination data does not include the past year when rates have risen sharply, the history shows a clear relationship between credit quality and interest rates. In the period depicted in the graph, the correlation coefficient for average DTI and the prime rate is .773.

The correlation coefficient is a measure of the strength of the relationship between variables. A coefficient of 0 is no correlation, and a coefficient of 1.0 is perfect correlation. In the period of 2006-2007, when rates hit 8.25%, on average 35% of home purchase originations had a DTI of greater than 44%. When rates were at 3.25% between 2009-2015, only 24% of home purchase originations had a DTI above 44%.

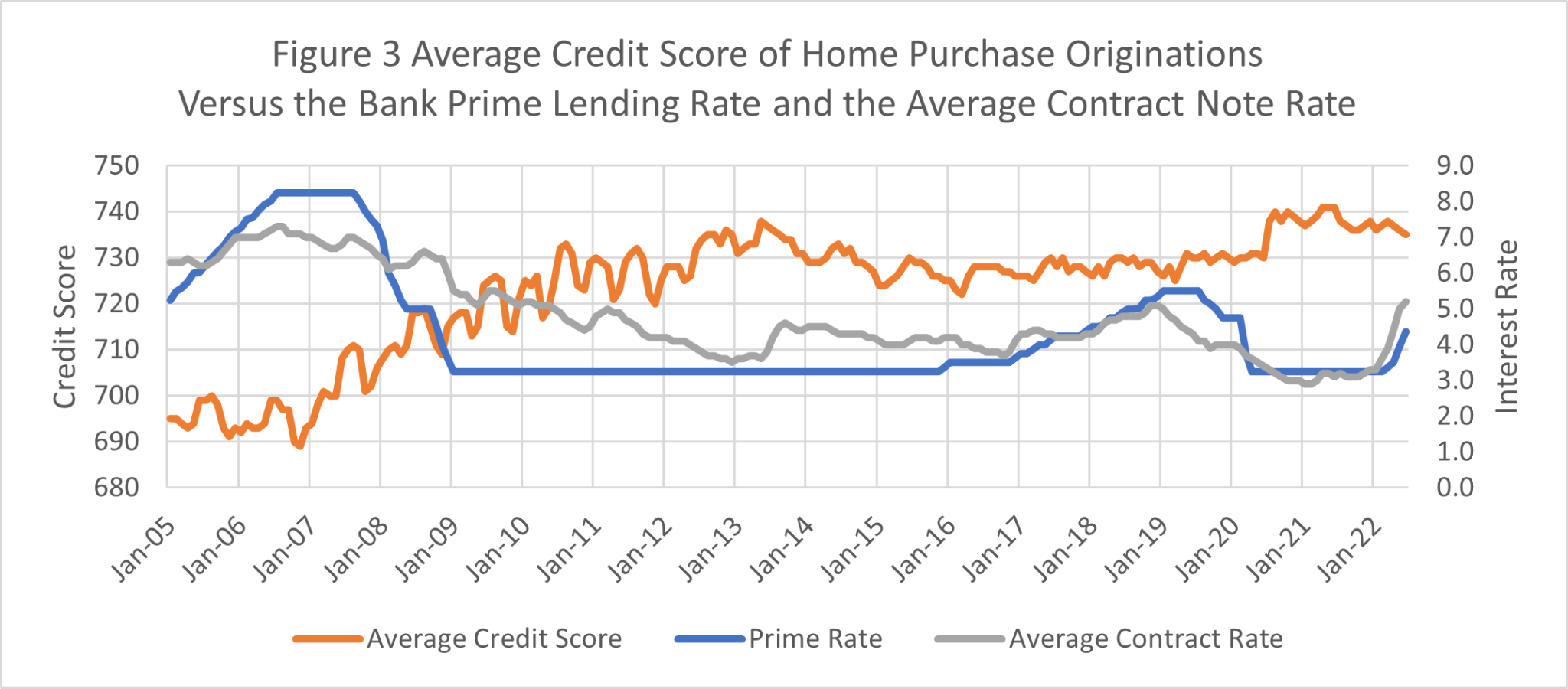

Figure 3 shows the inverse relationship between interest rates and average credit score for home purchase originations.

The correlation coefficient between credit score and the prime rate is -.801. The higher the interest rate, the lower the average credit score for home purchase loan originations. The correlation between credit score and contract rate is even greater at -.904. Note that as rates fell following the 2008-2009 recession, credit quality rose.

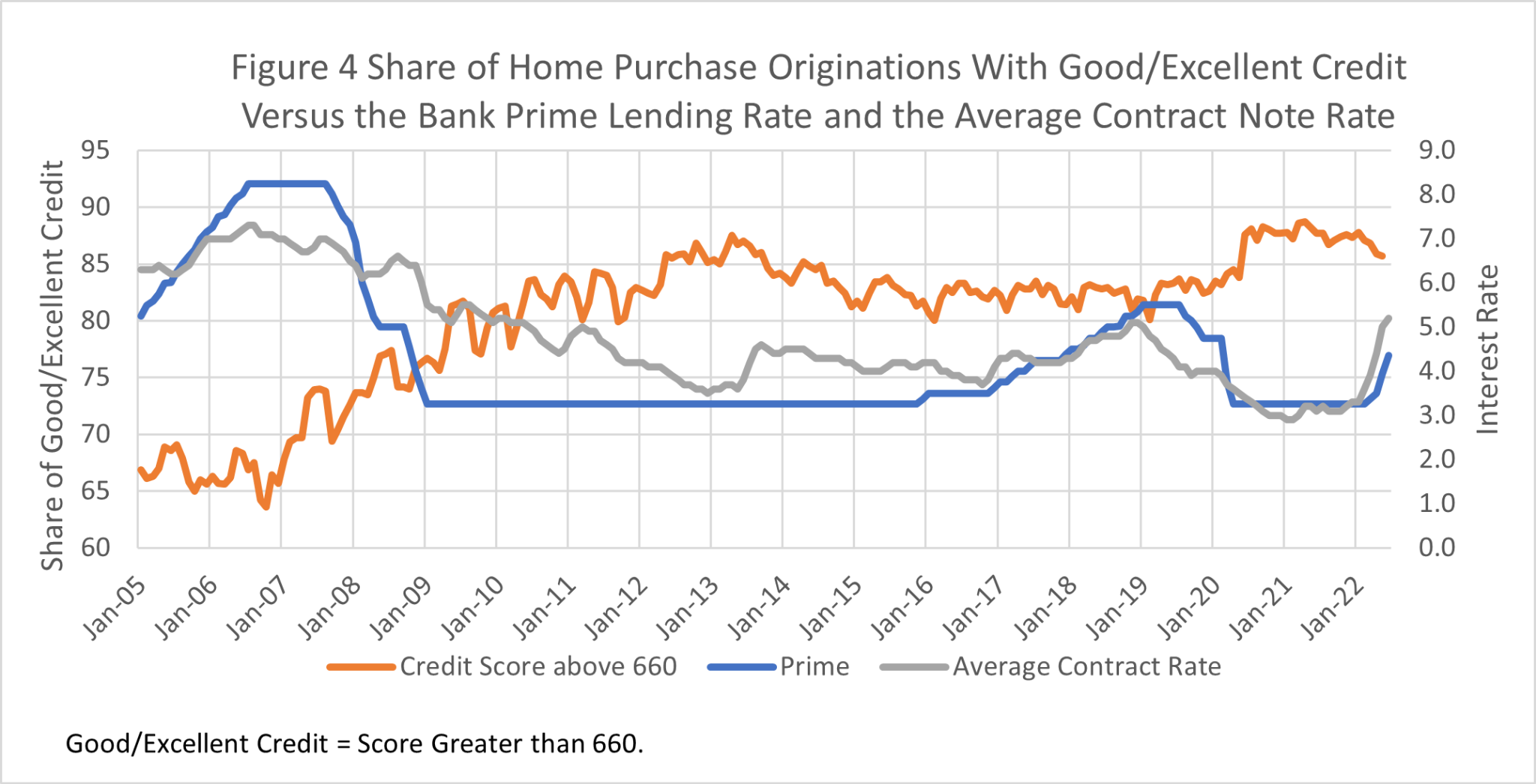

Conversely, when rates have risen, credit quality has diminished as illustrated in Figure 4. In 2006-2007 when the prime was at 8.25%, the share of home purchase originations with excellent credit (781 or better) was only 16.1% on average. During the 2009-2015 period when prime held steady at 3.25%, the share of home purchase originations with excellent credit was 25.8%.

The data suggests that those with good credit tend to avoid borrowing when interest rates rise. This means a greater proportion of lower quality credit loans are made during peaks of high interest rates.

With weakening economic conditions, lenders brace for higher-than-expected losses. The high interest rate environment of the last few years potentially adds another layer of risks, and something that should be considered.

In addition to asset quality concerns, the environment also has fair lending implications. With the pressures from the regulatory and enforcement agencies with regard to lending to minority borrowers and minority communities, some lenders have developed special products with flexible underwriting standards in order to compete for these credits. With tightening conditions, lenders that are currently relying on such products to fulfill their regulatory obligations may find this difficult to sustain, especially if other facets of their portfolios are showing signs of stress due to lower overall asset quality.

These are important considerations with regard to managing both safety and soundness and fair lending risk.