In previous posts (see The Fair Lending Risk of Good Intentions) we have discussed fair lending risks associated with certain well-intended practices. In an effort to avoid fair lending risks, institutions may find it tempting to have practices that either favor protected classes or policies that eliminate any variation in pricing or decisioning in an attempt to remove fair lending risk. Such seeming shortcuts, even if done for the right reasons, can create new issues rather than fix existing ones.

Unintended Consequences

The cardinal rule of policy analysis is the law of unintended consequences. Almost without exception, every policy will have both some intended and unintended effects. This is invariably true in the fair lending space because of the complexity of the lending process and the diversity of individual borrower situations. This is further amplified by the wide array of possible fair lending pressure points in a fair lending examination. In short, nothing happens in a vacuum. One cannot isolate or make a change that will only affect one component of the process or lending outcomes. Changes to existing policies or addition of new policies will have ancillary effects, many of which may not be recognized; and, even if they are, the effects are difficult to predict.

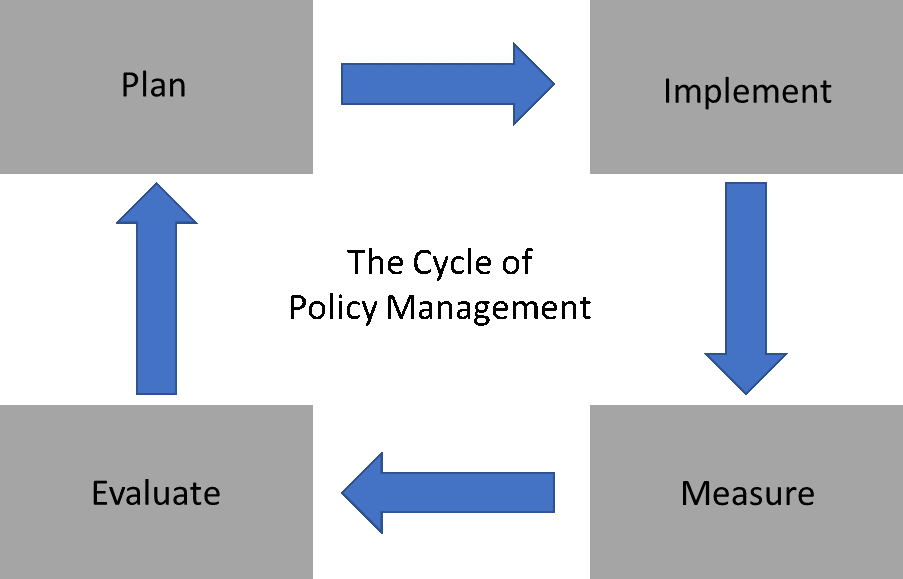

Put more simply, an institution is in complete control of its policies and practices, assuming they have mechanisms in place to enforce them. What they are not in complete control of, however, is the effects of these policies and practices. This must be understood, and suggests that adjustments and changes must be done in a methodical and measured way, and coupled with evaluation of the impacts. Managing policies and practices is really more of a process and is cyclical.

Not only must an institution manage its loan policy, it must also adjust to changes brought on by market conditions, demand for products, and the regulatory environment. As an example, 2020 was the COVID year that brought about a great deal of uncertainty and unexpected market dynamics. No one predicted the unprecedented volume of lending or the explosion in asset values, such as real estate. This further highlighted some of the tensions encountered with respect to loan policy between balancing consumer compliance issues and safety and soundness and other critical priorities. With the potential for so many differing cross-currents, it can be very difficult to formulate policies that achieve one specific outcome.

That brings us to the topic of this post, and that is using shortcuts to affect change. If one understands the complexities as described above, it is unrealistic to think that policy changes can be formulated that will have a direct, and singular effect on overall fair lending performance. Instead, using such an approach may create other issues. Let’s consider an example.

Example 1: Favoring Protected Groups Gone Wrong

Suppose a lender wants to create a policy that favors protected groups with respect to underwriting decisions. They decide to make exceptions to policy for Hispanic applicants. Obviously, the favoring of one group or another based on prohibited factors is a potential issue in and of itself and may be problematic. Laying that aside, however, it could also inadvertently create another issue.

Let’s suppose the lender is successful in creating more favorable outcomes for Hispanic borrowers relative to credit decisions. However, if the pool of Hispanic applicants tended to be mostly male, they would also be inadvertently favoring male applicants as well. One can see how this may create an unintended situation where male applicants are being favored over female applicants. In this case, the policy may have the intended effect, but it may also create another problem that did not exist prior to the policy change. This is just one example, but there are countless ways a well-intended policy can have adverse impacts.

Example 2: Flat Rate Failure

Another approach that is sometimes used in an attempt to create consistency is to adopt somewhat of a “flat” policy in that there is very little variation in underwriting, or more commonly pricing. In other words, instead of having different rates based on risk, there is a “one-size-fits-all” approach where there is just one rate that is charged. In this situation, borrowers receive the same rate regardless of their risk profile. While this may sound prudent with respect to fair lending, it has some implications that must be considered.

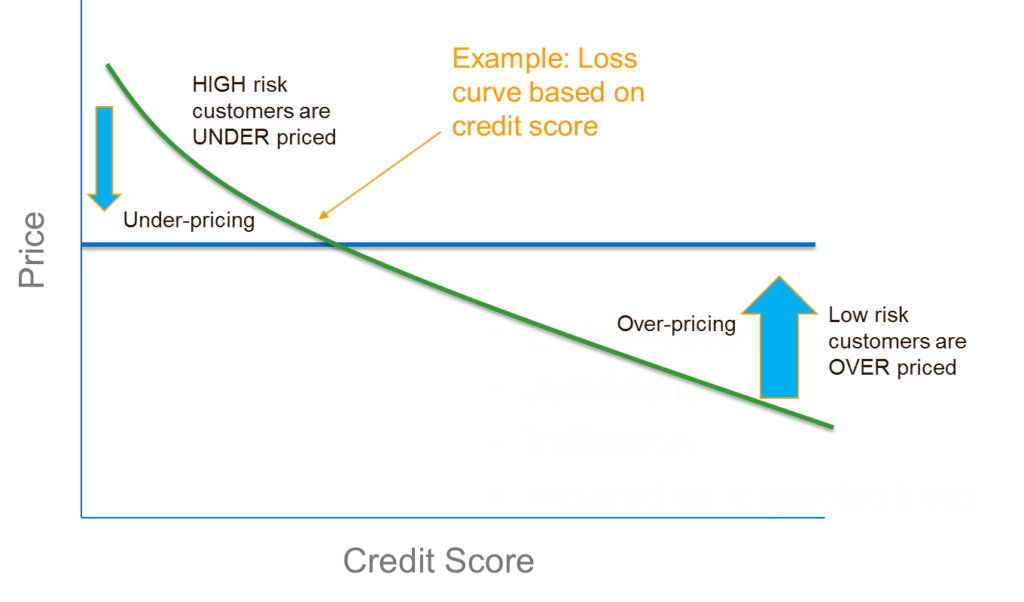

Let’s look at it first from a business standpoint. If the same rate is charged on loans, regardless of risk, there is an average rate that is going to have to be settled on that will be charged on all loans. This works fine for the average customer, but what about customers that are not average? The result is that low-risk borrowers are over-charged and high-risk borrowers are under-charged. There are potential consequences associated with each of these.

For example, the over-charged, low-risk customers may choose to take their business elsewhere. The institution would then be faced with a choice of either losing the business OR making exceptions to their policy. The former is not desirable; and the latter, of course, undermines the purpose of implementing the one-sized pricing policy in the first place.

Under-charging high-risk customers also has implications. In addition to taking on more risk that is not accounted for in the pricing structure, there is an equally important possible fair lending implication associated with this – higher denial rates for these borrowers. Since the greater risk is not accounted for in the loan pricing, the only way to mitigate the additional risk is to deny these loans. (Or require more stringent terms and conditions from these customers, which again undermines the intent). The institution may be unlikely to make these riskier loans at the lower rate, whereas if they were pricing for the risk, they might.

As shown by the graph below, such a policy tends to cut off the ends of the distribution – low risk customers can obtain lower pricing and typically do, and high-risk customers end up being denied more often. The former invites (and possibly necessitates based on market conditions) more pricing exceptions, and the latter denies credit to borrowers who may be credit worthy but simply higher risk. Depending on the attributes of the borrowers with credit challenges, such a policy can have wide reaching implications with regard to CRA, redlining, and fair lending general, as it will unavoidably narrow the range of credit offerings.

The Effective Lending Policy Cycle

The point is that there really are no shortcuts when it comes to managing regulatory issues, and especially fair lending. An institution must have a holistic approach to their policy as well as understand their customer base and communities in which they serve. As depicted by the graphic below, it also must be an ongoing process in which evaluation is done and changes made as necessary, but that take into account the entire process. There also must be a recognition that processes are all interconnected, and even seemingly minor changes can have wider implications. And, that even without the institution making changes, the environment is constantly changing and adjustments have to be made. Such changes include market conditions, competitive forces, and regulatory changes, just to name a few. This again highlights the critical nature of having an ongoing process.

Getting There From Here

What does this process look like with regard to fair lending, and where does an institution start?

The first step is to understand what the full ramifications are of policies and practices that are in place now, with respect to the environment as it is today. This is inclusive of all the fair lending pressure points and all product offerings and credit delivery channels. This can only be accomplished with a complete and thorough analysis to include some historic assessment.

The second step is to have an understanding of what the true practices are. Many times, the policy and practices are not the same, or there is variation in the way the policies are applied across the institution. It is probably safe to say this is universally true, no matter how much monitoring is in place.

The third step, once the above is complete, is to evaluate the positives and negatives and consider the tradeoffs associated with each. The approach then shifts to a forward-looking framework in which the driving force is to develop policies and products that maximize the positives and minimize the negatives. There are different ways this can be done, from a back-of-the envelope approach to more sophisticated techniques.

There are a number of tools in our toolkit that we utilize, including modeling and technology to project and estimate the effects of changes and to target optimization among the various fair lending and tradeoffs. This allows us to not only quantify impacts but also better enforce practices by leveraging technology. Whichever approach is used, it must be one in which there is vigilance in terms of monitoring, measuring impacts, and responding to changes.

An institution’s processes and practices are creating data that will be examined during regulatory reviews. Looking ahead is the only way to shape what these data will look like and provides the best chance of success in navigating these treacherous waters.

How to cite this blog post (APA Style):

Premier Insights. (2021, April 8). There Is No Shortcut to Effective Fair Lending Policy [Blog post]. Retrieved from https://www.premierinsights.com/blog/there-is-no-shortcut-to-effective-fair-lending-policy.